A Playbook for Core Conversions and Audit

Any time an institution changes its core technology provider, it is an extremely important decision. While all financial institutions use at least one core technology provider, they are not all the same. Many of the core technology providers have systems that may be sloppy but functional. As a result the financial institution may decide that a core technology provider conversion is the answer. There are other times when a core technology provider simply sunsets a program being used. In this instance the institution must also begin the process of selecting a new core technology provider. Any conversation involving a core technology system conversion must be incorporated in the Change Management processes of the institution.

The institutions’ Change Management process must ensure the Board and senior management group are the driving forces and ultimate decisionmakers. They must provide the directives for the institution when determining whether or not to undergo a conversion. Even the simplest of core technology conversions are sure to cause disruptions to daily processes and thus it is imperative to know the specific requirements involved. It is for this reason that research plays a major role in deciding whether it makes strategic and financial sense to select a specific core technology provider.

The Change management process should be designed to make the conversion as smooth and seamless as possible. For smaller community banks this process can be extremely difficult since most all employees will have to be involved in the process. It is increasingly challenging for small banks that already have resources constrained since the conversion requires that all of the bank’s data be transferred from one vendor’s system to another’s. Not to mention the process of testing and verifying the information transferred.

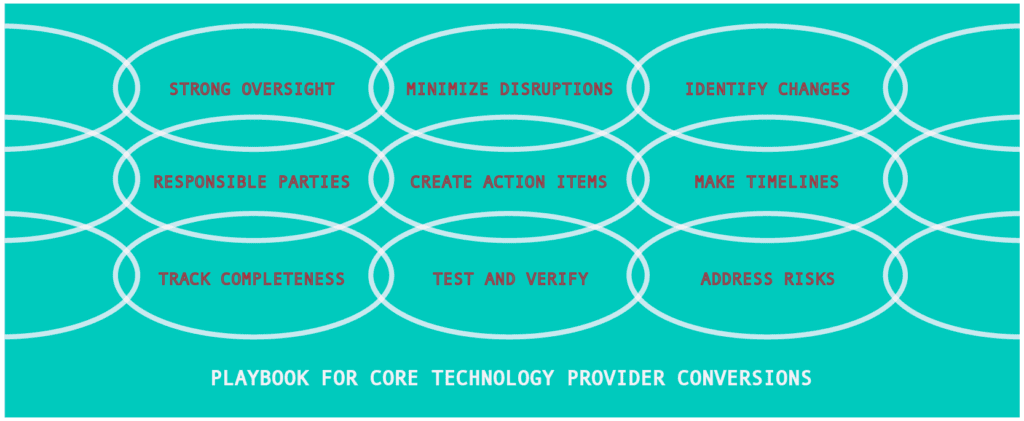

Being prepared and utilizing a strong Change Management process will help every institution who is considering or completing a core technology provider conversion. A strong Change Management process will include identification of specific changes, action items, parties responsible for activities, due dates for activities, results of implementation, and be repeatable. Strong Change Management processes allow for auditor and examiner to easily see the project at various stages of completeness. Auditors and regulators will also be able to track the process and mitigating factors decided upon by the institution, which will also demonstrate strong oversight from the Board and senior management group.

Strong Board and senior management oversight are imperative when an institution is making any internal modifications whether they are due to regulatory changes, or changes to products, or in this case a core technology conversions. Auditors and regulatory agencies across the country are looking at internal processes such as Change Management to ensure that institutions are adequately addressing apparent risks. They will also be considering activities such as these in the management rating of the financial institution at the time of an exam.